The PGA Tour has winnowed the list of companies being considered as private equity partners in its new for-profit entity, and it includes some of the most prominent figures in American finance, Golfweek has learned. From more than a dozen initial suitors, five groups remain in the mix to be the primary investment partner in PGA Tour Enterprises, which was created with the June 6 announcement of a Framework Agreement with the Saudi Arabian Public Investment Fund, which is also expected to invest in the entity that could reshape the elite level of men’s professional golf.

The five companies still under consideration are: Fenway Sports Group (FSG), which is partnered with investors Steven Cohen and Arthur Blank; Liberty Strategic Capital; Acorn Growth Companies; Eldridge Industries; and a group of influential individuals being referred to as Friends of Golf. Beyond the five groups bidding to be the Tour’s main private equity partner, several other companies remain in the conversation as potential investors of additional capital.

Eight sources who spoke with Golfweek on the matter requested anonymity because they are not authorized to comment publicly on it. The sports and entertainment behemoth Endeavor was the only company to make public its interest in investing with the Tour, but the agency’s president, Mark Shapiro, told Sportico last week that its bid had been rejected.

Preferred options from the group of five will be presented to the PGA Tour’s board of directors for discussion, perhaps as early as next week.

“Generally that is the plan, give or take a bit of time,” said one person familiar with the process. The board is scheduled to meet next on Nov. 12 in Ponte Vedra Beach, Florida.

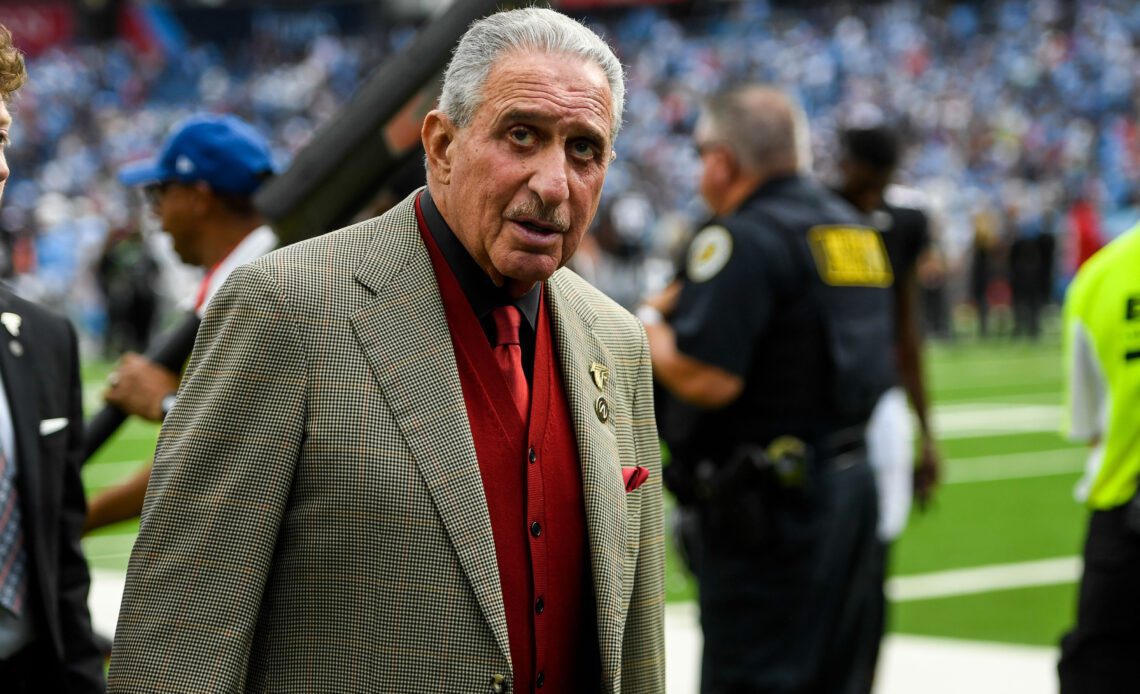

Of the remaining bidders, the most established track record in sports belongs to FSG, which owns the Boston Red Sox, Liverpool Football Club in the Premier League, and the NHL’s Pittsburgh Penguins. The company also recently invested in Boston Common, the team captained by Rory McIlroy in the soon-to-launch TGL indoor golf league. FSG’s bid to the Tour is supported by New York Mets owner Steven Cohen and Arthur Blank, whose assets include the Atlanta Falcons NFL team. Cohen and Blank also bought TGL teams earlier this summer.

Atlanta Falcons owner Arthur Blank walks off the field against the Tennessee Titans during the second half at Nissan Stadium on Oct. 29, 2023. Mandatory Credit: Steve Roberts-USA TODAY Sports

Acorn Growth Company’s portfolio was…

..

Click Here to Read the Full Original Article at Golfweek…